For those of you who that payed attention to TechCrunch 20 40, mint needs no introduction. mint walked away with the $50,000 prize and a boat load of publicity producing enough traffic to make their servers beg for mercy. With everything back up and running, I signed up for an account and gave it a test run. Despite all the buzz and hype I have to say I’m still very impressed.

Unlike Quicken (and others) where you have to enter your bank and credit card accounts manually, mint simply lets you enter your financial institutions login information and click submit - the rest of the work is done for you. It adds each account associated with that login, grabs transactions, categorizes them with amazing accuracy (Quicken is shameful at this), and slaps you in the face with money saving alternatives. If it sees $15,000 in a checking account earning 0% interest, it calculates how much you’d make per year by having it in an ING Direct account at 4% and offers a convenient link to sign up at ING.

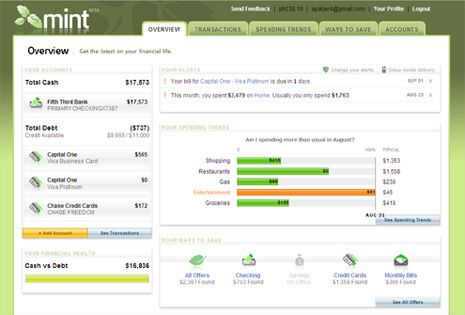

The charts are beautifully designed and allow you to compare spending from previous months. It recognizes bills and has the option to send you an email or SMS reminder. It also alerts you when it notices unusual activity, low balances and unwanted fees/charges. Over 3,500 financial institutions are on board already with more added daily.

In less than 5 minutes I had all of my CC’s, bank and saving accounts in mint. You can add them simultaneously through an ajax interface that will grab account info for one while you enter credentials for another. The whole thing is executed very well, especially for a site that just launched for the public a few days ago.

The best part is the price. mint is competitively priced at $FREE. The second best part? There are no ads. Well, no obvious ads at least. They make their money by making YOU money with affiliate kick backs if you decide to sign up for that ING account (which you should - because it’ll line your pockets). That’s a sweet twist on web app monetization, don’t you think?

TechCrunch 40 loves mint, and so do we.